Common Quickbooks Online Sync Errors

The following article covers common errors that can occur when syncing your Snapdocs data into Quickbooks online.

There are a few occasions in which the Quickbooks online sync will error. Most of them are caused by manually entering data into Quickbooks online so as a rule of thumb, remember to let the sync do its job.

Common reasons for sync failure

Duplicate invoice number sync error

This error occurs when someone has manually entered invoices into Quickbooks instead of letting the sync do it for them. For example: your company receives payment from a client and needs to mark the invoice as paid. The invoice is not yet in Quickbooks, so the Quickbooks user just adds the invoice manually. Snapdocs cannot sync an invoice number that is already in Quickbooks, therefore the next time someone syncs from Snapdocs, this error will occur.

First, use the search function to confirm that the invoice number is indeed in Quickbooks.

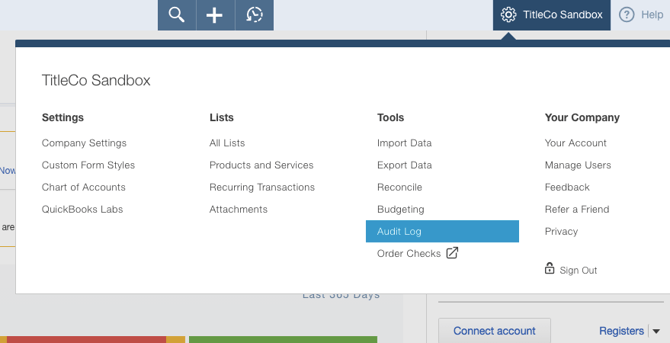

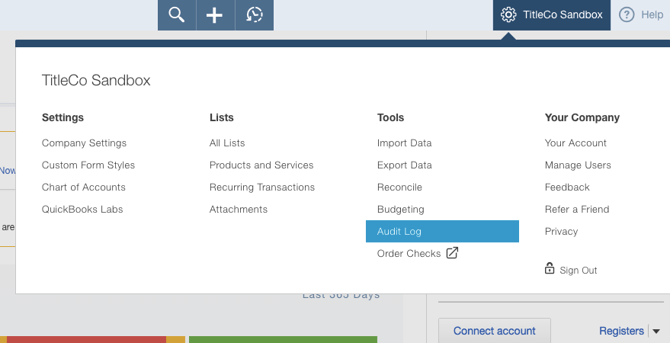

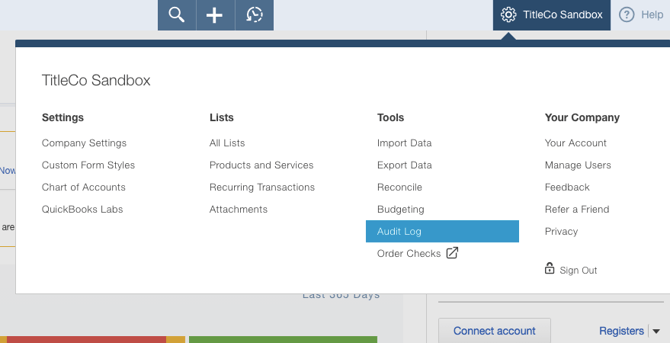

Next, use the audit log in Quickbooks to confirm that it was manually added. Select on your company name in the upper right corner, then on Audit Log in the drop down menu.

Search the audit log for the invoice number causing the error.

There are two ways to tell that it was manually added:

1. The timestamp on the action in the audit log will reveal whether it was during a sync or not. Just cross reference the times of the last few syncs with the timestamp on the action.

2. The user who originally set up the Quickbooks integration will always show in the audit log as the user who added the data from a sync. So for example if User A set up the integration, but User B clicks the sync button in Snapdocs, User B will appear in Snapdocs as the person who synced, but User A will appear in Quickbooks as the person who added the data. If the user who added the invoice is not the user who set up the sync, then it was manually added.

To resolve this, delete the manually added invoice or change the invoice number, so that Snapdocs can sync it to Quickbooks. We recommend adding text to the number that will uniquely identify the manually added invoice. Once you have deleted the invoice or changed the invoice number in Quickbooks, trying syncing again.

Duplicate bill number sync error

This error occurs when someone has manually entered bills into Quickbooks instead of letting the sync do it for them. For example: a Quickbooks user needs to cut a check for a notary but the bill is not in Quickbooks yet. Instead of syncing Snapdocs to Quickbooks, the user just adds the bill manually and cuts the check. Snapdocs cannot sync a bill number that is already in Quickbooks, therefore the next time someone syncs from Snapdocs, this error will occur.

First, use the search function to confirm that the bill number is indeed in Quickbooks.

Next, use the audit log in Quickbooks to confirm that it was manually added. Select on your company name in the upper right corner, then Audit Log in the drop down menu.

Search the audit log for the bill number causing the error. There are two ways to tell that it was manually added.

1. The timestamp on the action in the audit log will reveal whether it was during a sync or not. Just cross reference the times of the last few syncs with the timestamp on the action.

2. The user who originally set up the Quickbooks integration will always show in the audit log as the user who added the data from a sync. So for example if User A set up the integration, but User B clicks the sync button in Snapdocs, User B will appear in Snapdocs as the person who synced, but User A will appear in Quickbooks as the person who added the data. If the user who added the bill is not the user who set up the sync, then it was manually added.

To resolve this, delete the manually added bill or change the bill number so that Snapdocs can sync it to Quickbooks. We recommend adding text to the number that will uniquely identify the manually added bill. Once you have deleted the bill or changed the bill number in Quickbooks, trying syncing again.

Vendor or Customer name already in use

When Snapdocs syncs all of your order data to Quickbooks online, it sends over the Vendor, Customer, Bill and Invoice. If the Vendor or Customer has been added to Quickbooks manually, depending on the format, it could error. Every Vendor and Customer is synced to Quickbooks from Snapdocs with their unique Snapdocs ID number. So for example notary John Smith would be added to Quickbooks as John Smith #42351 (example of ID number). If you add a customer or vendor in that format manually, the sync will error.

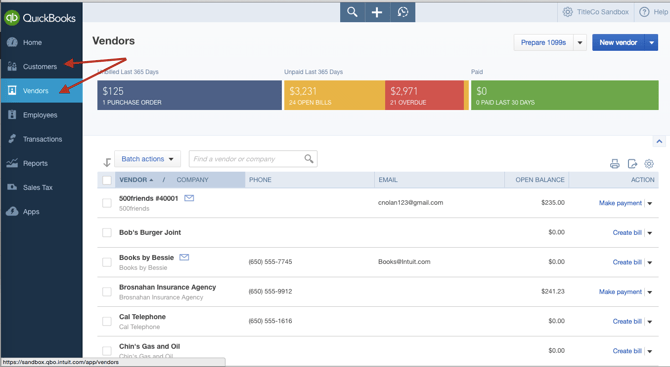

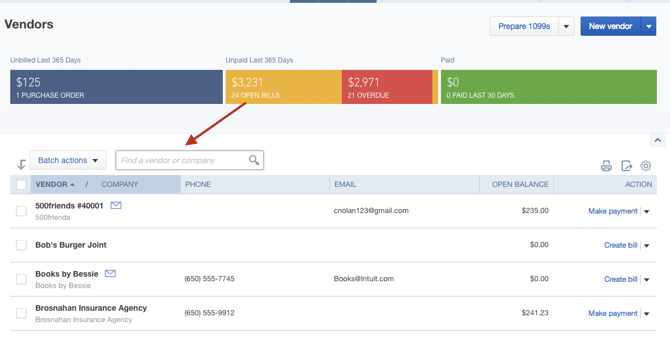

To confirm this issue, login to your Quickbooks account and click Vendors or Customers, whichever category is causing the sync error.

Use the search bar at the top of the list to find the Vendor or Customer in question.

You should find the Vendor or Customer in the following format [Vendor or Customer Name] [Unique Snapdocs ID number] example: John Smith #42351

Check your Quickbooks Audit Log to confirm that the Vendor or Customer was added manually by clicking on your company name in the upper right corner and Audit Log in the drop down menu.

Search through the Audit log to find the relevant action (adding the Vendor or Customer). There are 2 ways to tell if it was added manually.

1. The timestamp in the audit log on the action will reveal whether it was during a sync or not. Just cross reference the times of the last few syncs with the timestamp on the action in the Audit Log.

2. The user who originally set up the Quickbooks integration will always show in the audit log as the user who added data from a sync. So for example if User A sets up the integration, but User B clicks the sync button in Snapdocs, User B will appear in Snapdocs as the person who synced, but User A will always appear as the person who added the data to Quickbooks. If the user who added the Customer or Vendor is not the user who set up the sync, then it was manually added.

To resolve this, change the name on the Customer or Vendor account that was manually added, then try the sync again. You are able to merge duplicate Vendor and Customer accounts, just make sure you merge into the accounts added by the Snapdocs sync. Learn more about merging Vendor and Customer accounts.

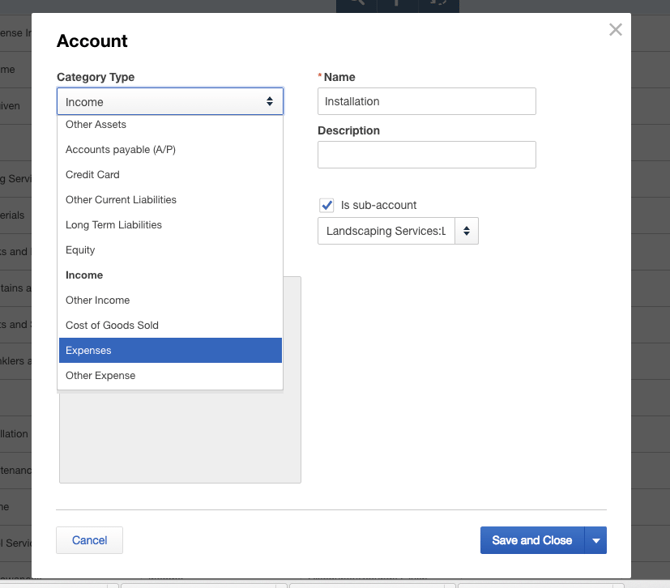

The service account is listed as a Category in Quickbooks

The service account selected in your Snapdocs QBO sync settings is a “Category” in Quickbooks, not a service or product account. The reason the sync is erroring is because Snapdocs cannot recognize an actual income account in Quickbooks to send your invoices to.

To resolve this:

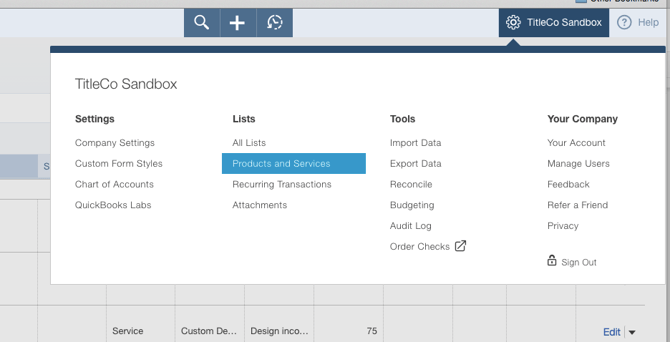

Step 1: Login to your Quickbooks account and click on your company name in the upper right corner then Products and Services under Lists.

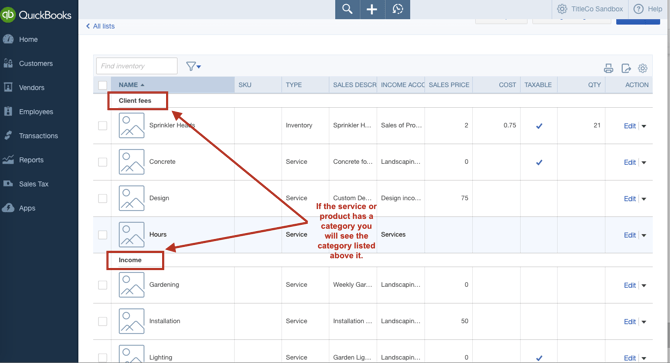

Step 2: You should see a list of all your Products and Services on the page that opens. If the product/service account is associated with a category, this is what your list will look like:

Step 3: Take note of what your categories are.

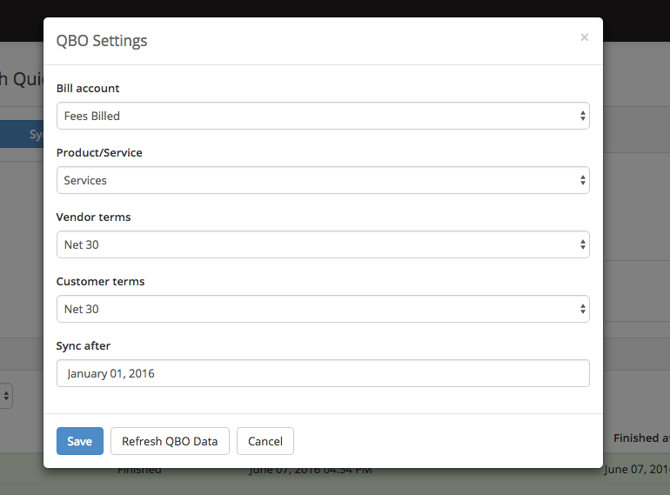

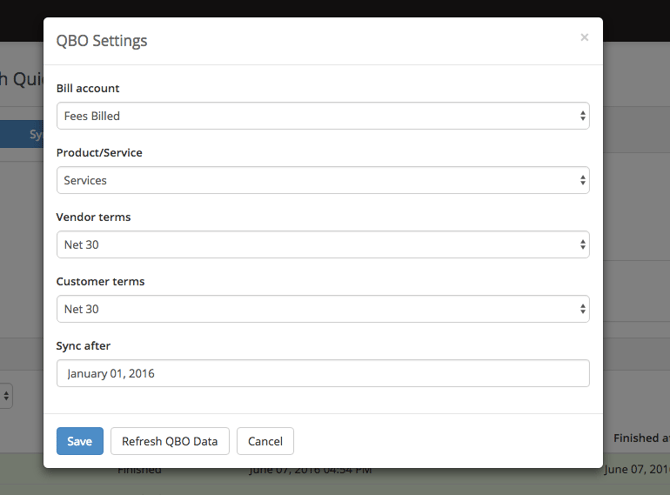

Step 4: Next, login to Snapdocs and go to the Quickbooks sync page (admin → accounting tools → Quickbooks online) then click on “edit settings.” This window should open:

Step 5: Select on the drop down for Product/Service. Make sure the option selected isn’t one of the categories that you took note of in step 3. The option chosen here has to be a Product/Service account in Quickbooks, not a category.

Step 6: Select Save and sync again.

Accounts Payable sync error

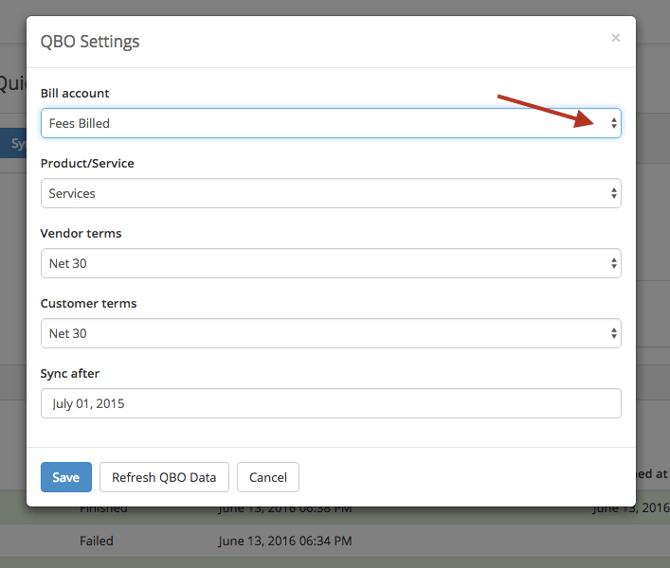

When you receive this error message, it is because the Bill Account linked to your sync settings in Snapdocs is an Account Payable, not an Expense. In order for the sync to work properly, the notary bills must be categorized as expenses in Quickbooks, not payables.

To resolve this, login to Snapdocs and click on Admin in the upper right corner then Accounting Tools in the drop down menu. Click on Quickbooks Online in the left column and then on Edit in the upper right corner of the Quickbooks Online settings box. You should see a page like this:

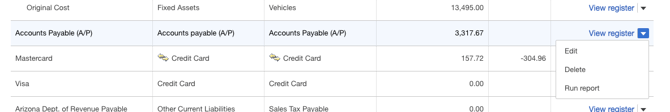

The Bill Account and Product/Service will populate directly from your Quickbooks account, so take a look at the current bill account and then check the chart of accounts within Quickbooks. This can be found by clicking on Transactions in the left column (of Quickbooks) and on the Chart of Accounts in the drop down list.

Your list of accounts will appear (similar to screenshot below). The second column on the chart of accounts is Type and will tell you whether the account is Accounts Payable A/P, Accounts Receivable A/R, Expenses, Income, Fixed Asset etc. If the account in your Snapdocs settings is listed in the chart of accounts as an Accounts Payable A/P, then the sync will error. There are two ways to fix this:

1. Edit the current account within Quickbooks to be an Expense not Accounts Payable. Click on the drop down arrow to the right and then on edit. You should be able to recategorize the account there.

2. Edit the settings in Snapdocs and choose a different Bill Account that is an Expense not Accounts Payable.

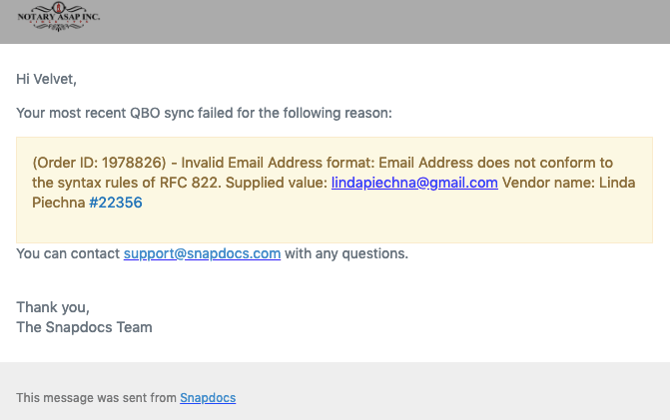

Email Syntax RFC 822 sync error

On rare occasions, this error will occur when a customer tries syncing Snapdocs with their Quickbooks. The primary issue is that the email being pulled from Snapdocs is invalid and does not follow the proper syntax.

Typically this results when a notary updates their email and does not enter it correctly into the email field in their profile.

Simply have the notary make sure there are no blank spaces before the beginning of their email address, and that everything in the email is correct.

Once updated, the sync should complete successfully once it is run again.