VendorPay FAQ

As a notary signing agent working with a company using VendorPay, you'll receive payment automatically via direct deposit.

What Is Snapdocs VendorPay?

VendorPay is Snapdocs' direct deposit payment system. Companies that use Snapdocs can choose to use VendorPay to pay the notary signing agents they work with. VendorPay is completely free to use for notaries.

Please note that only some companies on Snapdocs are currently enrolled in VendorPay, so only these companies will make their payments through direct deposit. For all other companies, they'll continue issuing payment via their regular method.

Important Note: Unlike regular orders, VendorPay orders do not have an option to "Mark as Paid." This is because we mark orders that are processed through VendorPay for you. This happens one day after we have received confirmation that your payment has been successfully deposited into your bank account.

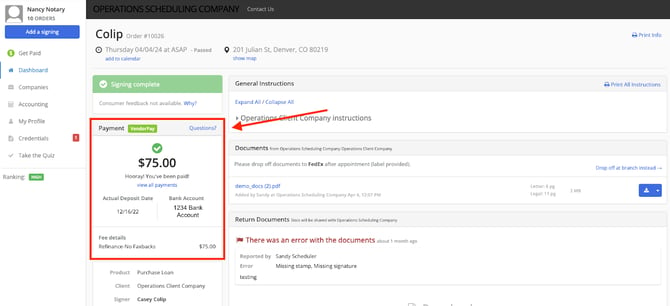

To identify when the payment will be or was deposited locate the Payment VendorPay box on the left-hand side of the order page.

Learn more about marking orders as paid here.

Is VendorPay Secure?

We recognize that security is a big concern for most notaries and security is definitely not something taken lightly at Snapdocs.

We do not actually have direct access to your bank account information. Companies that use Snapdocs do not have access to your bank information either. We recommend reviewing how Snapdocs ensures Security is Part of our Culture.

We use a third-party service called Stripe to securely connect your bank account to your Snapdocs account. Your bank account information is never seen by us or the companies you work with on Snapdocs.

Neither Snapdocs nor the companies you work with on the platform have the ability to withdraw or access money in your account. In the rare case of an erroneous deposit, we may need to reverse the transaction. If this happens, we will contact you before taking any action.

How Often Will I Get Paid?

Twice each month, on the 3rd and 18th, companies using VendorPay will be invoiced for the signings they processed in the previous billing period. In order for the payment to be processed, the appointment date must be before the 1st and the 16th, respectively. In addition, the order must be closed before the invoicing date, on the 3rd and the 18th of each month.

Companies are then charged 2 business days after they’re invoiced. When the invoice is successfully charged, we initiate payment transfers to notary signing agents. From the date we initiate payment transfers, it takes about 8-10 business days for the transfer to complete and for payments to actually show up in your bank account. Overall, notaries can typically expect to receive payment directly in your bank account within 1-3 weeks after a company closes an order.

We immediately then transfer the company's payment to you - this part of the process only takes 1-2 business days.

In total, the time that it takes for a company's payment to clear (this is when we notify you of your direct deposit payment) and the actual transfer time into your bank account can take between 8-10 days.

Complete payment terms and details are available at our Terms of Use.

What is Stripe?

Snapdocs partners with Stripe and Plaid to process VendorPay payments and manage tax forms. When a notary signs up for VendorPay they review and accept Stripe and Plaid's Terms of Service as well. A notary may receive direct communication from Stripe regarding the delivery of their 1099 form.

For questions related to 1099s review the 1099 FAQs article.Frequently Asked Questions

-

How can I get set up to receive direct deposit payments (via VendorPay)?

-

How can I tell whether a signing is paid through Snapdocs VendorPay or not?

-

With VendorPay, how can I track the status of my payment and easily match my payments to my orders?

-

Why do you need my Social Security Number for VendorPay direct deposit?

-

How do I know which bank account my payments have been deposited into?

-

I received payment through VendorPay direct deposit but it was for the wrong amount. What do I do?

-

How does the VendorPay microdeposit verification process work?

-

Why do direct deposit payments fail and what should I do if I have a failed payment?

-

What happens when direct deposit payments are sent to a closed bank account?